See Article Gold Charts: Warning In February Still Valid Today

__________________________________________________________ GOLDPIVOTS.COM CHART: GLD ETF: THIS WEEK'S FOCUS INTEREST TRADER'S EDGE EASYGUIDE CHART UPDATES WITH ADVANCED ECHOVECTOR MODEL ANALYSIS HIGHLIGHTS: WEDNESDAY 5 JUNE 2013 2:22AM EDST [Edit or Delete]0 comments

Jun 5, 2013 3:04 AM | about stocks: AGOL, DUST, FSG, GDX, GDXJ, GGGG, GLD, GLDX, GLL, IAU, NUGT, SGOL, TBAR, UGL, RING, DBB, DBP, GLTR, PSAU, XME, AGQ, DBS, SIL, SLVP, SIVR, SLV, ZSL, WITE, DGP, DGZ, DZZ, SPGH, UBG, UBM, USV, UGLD, DGLD

http://echovectorvest.blogspot.com/2013/06/goldpivotscom-chart-gld-etf-this-weeks.html

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP: INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME.

See Also Related Websites and Blogsites dowpivots.com, spypivots.com, goldpivots.com, oilpivots.com, bondpivots.com, dollarpivots.com, currencypivots.com, commoditypivots.com, emergingmarketpivots.com, etfpivots.com, and seekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest

DEFINITION: THE ECHOVECTOR

For any base security I at price/time point A, A found having print price p at print time t, then EchoVector XEV of I of time (cycle) length X for starting time/price point A would be (I,Apt,XEV) where the echovector's end point is (I,Apt) and the echovector's starting point is I,Ap-N,t-X, where N is the found print price difference between A and EchoBackTimePoint A (A,p-N,t-X at t-X) of Echo-Back-Time-Length, or Echo-Cycle Length, X. A,p-n,t-X shall be called B, or B of I, being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or Echo-Back-Date (EBD)*, or Echo-Back-Time-Point (EBTP) of A of I.

N = difference of p at A and p at B (B is the 'echo-back price-point, and time-point, of A, found at A,p-N,t-X.

And I (I,Apt,XEV) shall have an echobacktimepoint (EBTP) of At-X, or I-A-EBTP of At-X, (or echobackdate (EBD) I-A-EBD of At-X), t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[bars]), such as minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour,4-hour, 6-hour, 8-hour, daily, weekly, etc.

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP

EchoVectorVEST MDPP, PRECISION PIVOTS Providing Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Staying ahead of the curve, we're keeping watch for you!"

View my complete profile

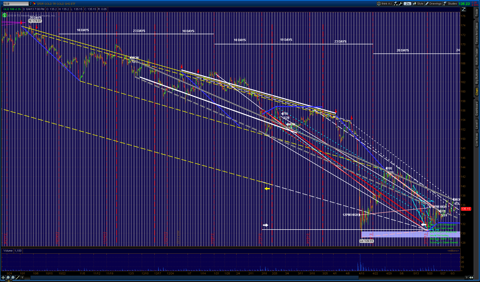

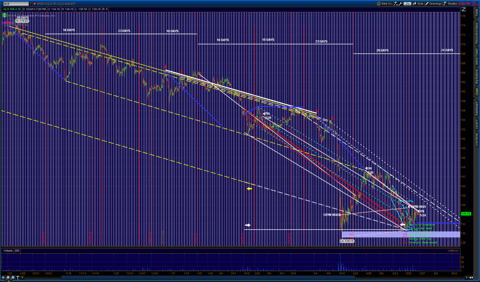

GLD ETF 8-MONTH 2-HOUR OHLC 2:22AM EDST

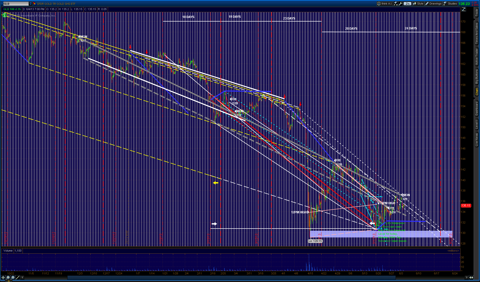

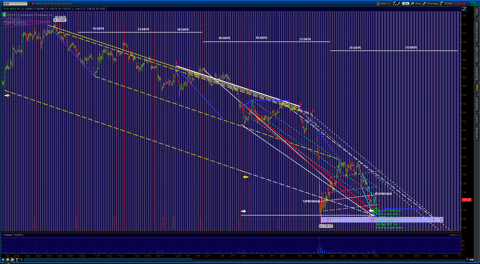

GLD ETF 8-MONTH 2-HOUR OHLC 2:29AM EDST

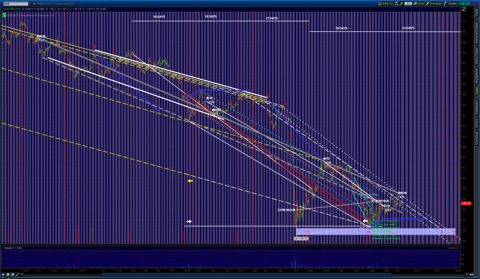

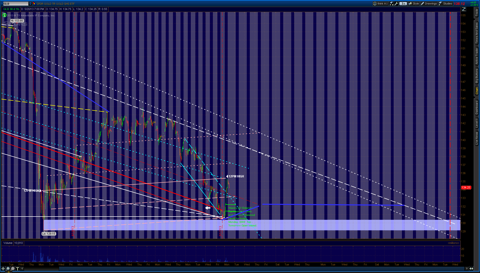

GLD ETF 8-MONTH 2-HOUR OHLC 2:31AM EDST

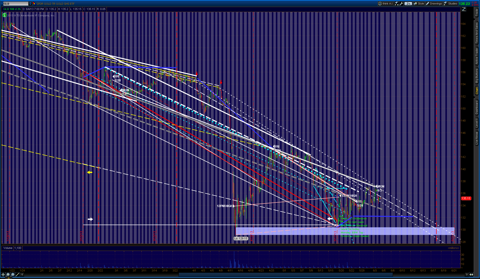

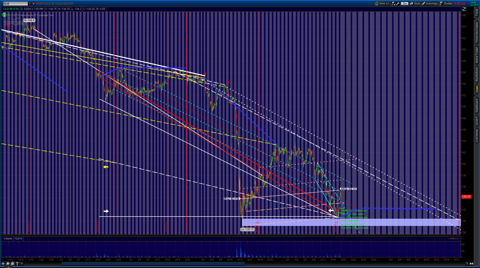

GLD ETF 8-MONTH 2-HOUR OHLC 2:41AM EDST

GOLDPIVOTS.COM

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS TRADER'S EDGE EASYGUIDECHART

PRECISION PIVOTS ECHOVECTORVEST MDPP MODEL OUTPUT CHART ILLUSTRATION AND HIGHLIGHTS COLOR CODE GUIDE

1. Regime Change Cycle EchoVector (8 Year, Week of month): Long Aqua-Blue

2. Regime Change Cycle EchoVector (8 Year, Week of month): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week of month): Long Pink

4. Presidential Cycle EchoVector (4 Year, Day of week): Long White

5. Congressional Cycle EchoVector (2 Year, Day of week): Green

6. Congressional Cycle EchoVector (2 Year, Day of week): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day of week): Long Pink

8. Congressional Cycle EchoVector (2 Year, Day of week): Long Yellow

9. Annual Cycle EchoVector (1 Year, Day of week): Red

10. Annual Cycle EchoVector (1 Year, Day of week): Pink

11. Annual Cycle EchoVector (1 Year, Day of week): Aqua-Blue

12. Annual Cycle EchoVector (1 Year, Day of week): Long Blue Purple

13. 9-Month Cycle EchoVector (9 Months, Day of week): Grey

14. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Yellow

15. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Grey

16. Quarterly Cycle EchoVector (3 Months, Day of week): White

17. Quarterly Cycle EchoVector (3 Months, Day of week): Grey

18. Quarterly Cycle EchoVector (3 Months, Day of week): Red

19. Quarterly Cycle EchoVector (3 Months, Day of week): Green

20. Bi-Monthly Cycle EchoVector (2 Months, Day of week): Black

21. Monthly Cycle EchoVector (1 Month, Day of week): Peach

22. Bi-Weekly Cycle EchoVector (2 Weeks, Day of week): Grey

23. Weekly Cycle EchoVector (1 Week, Day of week): Aqua Blue

24. Daily Cycle EchoVector (1 Day, Day-over-Day): Short Pink

25. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue

Space-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.

ECHOVECTORVEST MDPP PRECISION PIVOTS MODEL LOGICS:

Trend period echovector echo-period price point level.

Trend period echovector echo-period price point level pivot extension: equal.

Trend period echovector echo-period price point level pivot extension: stronger: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level pivot extension: weaker: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level REVERSAL: Counter-Echo Pattern: Trend period echovector slope pivoting.

EP: EchoPivot: Trend Timing and Price Vector and Period Corresponding Pivot.

EPCP: EchoPivot CounterPivotPivot: Trend Timing and Price Vector and Period CounterTrend Corresponding CounterPivot (Induces greater force-slope up, or weaker force-slope up, or greater force-slope down, or weaker force-slope down).

CLICK ON CHARTS TO HYPER-ZOOM CHARTS

________________________________________________________

GOLDPIVOTS.COM CHART: GLD ETF: THIS WEEK'S FOCUS INTEREST TRADER'S EDGE EASYGUIDE CHART UPDATES WITH ADVANCED ECHOVECTOR MODEL ANALYSIS HIGHLIGHTS: SATURDAY 25 MAY 2012 320AM EDST [Edit or Delete]0 comments

May 27, 2013 5:08 AM | about stocks: AGOL, DUST, FSG, GDX, GDXJ, GGGG, GLD, GLDX, GLL, IAU, NUGT, SGOL, TBAR, UGL, RING, DBB, DBP, GLTR, PSAU, XME, AGQ, DBS, SIL, SLVP, SIVR, SLV, ZSL, WITE, DGP, DGZ, DZZ, SPGH, UBG, UBM, USV, UGLD, DGLD

http://echovectorvest.blogspot.com/2013/05/goldpivotscom-chart-gld-etf-this-weeks.htmlEchoVectorVEST

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP: INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME. See Also Related Websites and Blogsites dowpivots.com, spypivots.com, goldpivots.com, oilpivots.com, bondpivots.com, dollarpivots.com, currencypivots.com, commoditypivots.com, emergingmarketpivots.com, etfpivots.com, and seekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest

PRECISION PIVOTS

ProtectVest and AdvanceVEST By EchoVectorVEST MDPP Precision Pivots

Providing Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again From Early 2009 Through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!

Saturday, May 25, 2013 GOLDPIVOTS.COM CHART: GLD ETF: THIS WEEK'S FOCUS INTEREST TRADER'S EDGE EASYGUIDE CHART UPDATES WITH ADVANCED ECHOVECTOR MODEL ANALYSIS HIGHLIGHTS: SATURDAY 25 MAY 2012 320AM EDST GLD ETF 8-MONTH 2-HOUR OHLC CHART

(click to enlarge)

______________________________________________________________

______________________________________________________________GLD ETF: TODAY'S FOCUS INTEREST TRADER'S EDGE EASYGUIDE CHART UPDATES WITH ADVANCED ECHOVECTOR MODEL ANALYSIS HIGHLIGHTS

May 21, 2013 12:05 AM | about stocks: AGOL, DUST, FSG, GDX, GDXJ, GGGG, GLD, GLDX, GLL, IAU, NUGT, SGOL, TBAR, UGL, RING, DBB, DBP, GLTR, PSAU, XME, AGQ, DBS, SIL, SLVP, SIVR, SLV, ZSL, WITE, DGP, DGZ, DZZ, SPGH, UBG, UBM, USV, UGLD, DGLD

UPDATES BROUGHT TO SEEKINGALPHA BY GOLDPIVOTS.COM:

http://echovectorvest.blogspot.com/2013/05/gld-etf-chart-update-9-month-2-hour.html

EchoVectorVEST MDPP PRECISION PIVOTS

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP: INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME.

ProtectVest and AdvanceVEST By EchoVectorVEST MDPP Precision Pivots

Providing Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market(Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Staying ahead of the curve, we're keeping watch for you!"

GOLDPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. FIND MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR GOLDPIVOTS.COM FOCUS ETFS AND FUTURES AT ECHOVECTORVEST.BLOGSPOT.COM (LISTED 1ST IN LINKS ON RIGHT AT SITE). See echovectorvest.blogspot.com and seekingalpha.com/author/kevin-wilbur/ins... in addition to goldpivots.com

See Also Related Websites and Blogsites dowpivots.com, spypivots.com, goldpivots.com, oilpivots.com, bondpivots.com, dollarpivots.com, currencypivots.com, commoditypivots.com, emergingmarketpivots.com, and seekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest

BI-QUARTERLY (Yellow) AND QUARTERLY (White) ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS (Spaced) AND KEY ECHOBACKDATES AND ECHOBACKTIMEPOINTS AND ECHOBTIMEPERIODS WITH KEY ECHO-WAVE DIFFERENTIATIONS AND EXTENSIONS AND KEY MONTHLY OPTION EXPIRATION BASED ECHO-TRADING RANGE PHASE ADJUSTMENTS INCLUDED

FOCUS CFEVs:

1. Bi-Quarterly (2QEV, Select Echo-Start Point-BASED): 2QEV LENGTHED CFEVS: Spaced Yellow.

2. Quarterly: (QEV, Select Echo-Start Point-BASED) 59 DAY (DEC-JAN FEB) TO 67 DAY (MAR APR MAY) QEV LENGTHED CFEVS: Spaced White, Spaced Red, Dotted Blue, Dotted White.

3. Monthly (MEV, Select Echo-Start Point-BASED): 2WEV LENGTHED CFEVS: Spaced Pink, Dotted Pink.

4. Weekly (WEV, Select Echo-Start Point-BASED): 2WEV LENGTHED CFEVS: Spaced Aqua-Blue.

GLD ETF 200-DAY 2-HOUR OHLC PERSPECTIVE

WITH COORDINATE FORECAST ECHOVECTOR HIGHLIGHTS

(click to enlarge and continue to click to further zoom)

GLD ETF 30-DAY 1-HOUR OHLC PERSPECTIVE

WITH COORDINATE FORECAST ECHOVECTOR HIGHLIGHTS

(click to enlarge and continue to click to further zoom)

GLD ETF 100-DAY 1-HOUR OHLC PERSPECTIVE

WITH COORDINATE FORECAST ECHOVECTOR HIGHLIGHTS

(click to enlarge and continue to click to further zoom)

___________________________________________________________

GOLDPIVOTS.COM GOLD PRICE MDPP PRECISION PIVOTS TRADER'S EDGE EASYGUIDECHART

PRECISION PIVOTS ECHOVECTORVEST MDPP MODEL OUTPUT CHART ILLUSTRATION AND HIGHLIGHTS COLOR CODE GUIDE

1. Regime Change Cycle EchoVector (8 Year, Week of month): Long Aqua-Blue

2. Regime Change Cycle EchoVector (8 Year, Week of month): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week of month): Long Pink

4. Presidential Cycle EchoVector (4 Year, Day of week): Long White

5. Congressional Cycle EchoVector (2 Year, Day of week): Green

6. Congressional Cycle EchoVector (2 Year, Day of week): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day of week): Long Pink

8. Congressional Cycle EchoVector (2 Year, Day of week): Long Yellow

9. Annual Cycle EchoVector (1 Year, Day of week): Red

10. Annual Cycle EchoVector (1 Year, Day of week): Pink

11. Annual Cycle EchoVector (1 Year, Day of week): Aqua-Blue

12. Annual Cycle EchoVector (1 Year, Day of week): Long Blue Purple

13. 9-Month Cycle EchoVector (9 Months, Day of week): Grey

14. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Yellow

15. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Grey

16. Quarterly Cycle EchoVector (3 Months, Day of week): White

17. Quarterly Cycle EchoVector (3 Months, Day of week): Grey

18. Quarterly Cycle EchoVector (3 Months, Day of week): Red

19. Quarterly Cycle EchoVector (3 Months, Day of week): Green

20. Bi-Monthly Cycle EchoVector (2 Months, Day of week): Black

21. Monthly Cycle EchoVector (1 Month, Day of week): Peach

22. Bi-Weekly Cycle EchoVector (2 Weeks, Day of week): Grey

23. Weekly Cycle EchoVector (1 Week, Day of week): Aqua Blue

24. Daily Cycle EchoVector (1 Day, Day-over-Day): Short Pink

25. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue

Space-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.

ECHOVECTORVEST MDPP PRECISION PIVOTS MODEL LOGICS:

Trend period echovector echo-period price point level.

Trend period echovector echo-period price point level pivot extension: equal.

Trend period echovector echo-period price point level pivot extension: stronger: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level pivot extension: weaker: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level REVERSAL: Counter-Echo Pattern: Trend period echovector slope pivoting.

EP: EchoPivot: Trend Timing and Price Vector and Period Corresponding Pivot.

EPCP: EchoPivot CounterPivotPivot: Trend Timing and Price Vector and Period CounterTrend Corresponding CounterPivot (Induces greater force-slope up, or weaker force-slope up, or greater force-slope down, or weaker force-slope down).

HYPER-ZOOM CHARTS

LINKS

- EchoVectorVEST MDPP Precision Pivots Model Highlights and Illustrations Color Code Guide: Active EchoVectors and Coordinate Forecast EchoVectors

- EchoVectorVEST MDPP at Twitter

- EchoVectorVEST MDPP at SeekingAlpha/Instablogs

- EchoVectorVEST MDPP at SeekingAlpha/Articles

- EchoVectorVEST MDPP at Our Record

- What Is EchoVectorVEST MDPP?

- ProtectVEST and AdvanceVEST MDPP Precision Pivots Active Advanced Position Management Technology "On/Off/Through Target Application Price Switch (OTAPS)"

- ProtectVEST and AdvanceVEST MDPP Precision Pivots Active Advanced Management Strategies: Derivatives Baskets Reference Guide

OTAPS ALERTS

Introducing the Active Advanced Management On/Off/Through Vector Target Application Price Switch. Position Management and Value Optimization Technology.

POSITION DOUBLE LEVERAGE AND DOUBLE DOUBLE LEVERAGE ALERTS

Introducing P&A Active Advanced Management Double and Double Double Positioning Technology For Select Instruments and Key Focus Interest Opportunity Periods

OPTIMIZING LEVERAGE WITH DERIVATIVES AND SYNTHETICS

Introducing ProtectVEST and AdvanceVEST Active Advance Derivatives Management Levels 1, 2, 3 , and 4 Technology For Position Value Hedging and Value Optimizing Strategies

RELATED LINKS

- DOWPIVOTS.COM CHARTS

- GOLDPIVOTS.COM CHARTS

- OILPIVOTS.COM CHARTS

- BONDPIVOTS.COM CHARTS

- DOLLARPIVOTS.COM CHARTS

- CURRENCYPIVOTS.COM CHARTS

- COMMODITYPIVOTS.COM CHARTS

- EMERGINGMARKETPIVOTS.COM CHARTS

- SPYPIVOTS.COM CHARTS (S&P500PIVOTS)

- MDPP PRECISIONPIVOTS.COM CHARTS (COMPREHENSIVE SITE)

- OUR CHARTS ON TWITTER

- OUR CHARTS AT SEEKINGALPHA

- CHART COLOR CODE GUIDE AND BASIC LOGICS

▼ 2013 (418)

FORECAST MODEL & ALERT PARADIGM & ACTIVE ADVANCED MANAGEMENT & TRADE TECHNOLOGY

For information on EchoVectorVEST MDPP Active Advance Management Trade Technology and Active Advance Management Position Value Optimization Methodology see:

http://echovectorvest.blogspot.com/2012/05/on-off-through-vector-target.html

*Daytraders interested in shorter-term market mechanics and OTAPS ALERTS also taking advantage of intra-day time-horizon price deltas and advanced OTAPS position management technologies for the DIA, GLD, and USO, also see:

http://www.echovectorvest.blogspot.com/

Also see Chronologies and Summaries and Results for the EchoVectorVEST MDPP Major Price Delta and Price Pivot ALERTS for the Gold Metals Market (GLD ETF /GC Futures) and the Crude Oil Market (USO ETF and /QM and /CL Futures) in Q2, 2012, and in Q1.

EchoVectorVEST MDPP: Powerful Results From A Powerful, Active, and Advanced Forecast And Position Management Methodology.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Staying ahead of the curve, we're keeping watch for you."

________________________________________________________

FOR TODAY'S KEY CHARTS AND ANALYSIS, SEE:

EchoVectorVEST MDPP

AND,

http://seekingalpha.com/author/kevin-wilbur/instablog/full_index

________________________________________________________

Click on the links below for direct access to the following:

OUR RECORD:

www.echovectorvest.com/OUR RECORD

OUR RESEARCH:

www.echovectorvest.com/OUR RESEARCH

OUR CURRENT FOCI:

www.echovectorvest.com/OUR CURRENT FOCUS INSTRUMENTS

TRADEMARK MODEL ONTOLOGY AND TERMINOLOGY MATRIX:

www.echovectorvest.com/THE ECHOVECTORVEST MDPP TRADEMARK TERMINOLOGY MATRIX

ACTIVE ADVANCED POSITION MANAGEMENT TECHNOLOGY:

www.echovectorvest.blogspot.com/PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP ADVANCED ACTIVE POSITION MANAGEMENT TECHNOLOGY:THE ON/OFF/THROUGH VECTOR TARGET APPLICATION PRICE SWITCH

EXHIBIT WEEK RESULTS:

www.echovectorvest.blogspot.com/ADVANCED MANAGEMENT EXHIBIT WEEK RESULTS FOR THE GLD ETF AND THE DIA ETF

HIGH FREQUENCY TRADING DEMONSTRATION:

www.echovectorvest.blogspot.com/ECHOVECTORVEST MDPP HIGH FREQUENCY TRADING DEMONSTRATION AND POSITION TERMINOLOGY

DIAMOND OF SUCCESS:

www.echovectorvest.com/THE DIA ETF: THE DIAMOND OF SUCCESS

GOLD METALS:

www.echovectorvest.com/THE GLD ETF AND GOLD METALS

LIGHT SWEET CRUDE OIL:

www.echovectorvest.com/THE USO AND LIGHT SWEET CRUDE OIL

BIO, FOUNDER:

www.echovectorvest.com/BIO, PRESIDENT AND FOUNDER

Posted by EchoVectorVEST

________________________________________________________

What is ECHOVECTORVEST MDPP?

________________________________________________________

DISCLAIMER

This post is for information purposes only.

There are risks involved with investing including loss of principal. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP.

There is no guarantee that the goals of the strategies discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP will be achieved.

NO content published by us on the Site, our Blog, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for information purposes only.

Before making any investment decisions we recommend you first consult with you personal financial advisor.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP

"We're keeping watch for you."

TAGS: Stock Market Education, ETF Analysis, Major Market Composite Index, Market Outlook, Market Analysis, Technical Analysis, Cyclical Analysis, Price Analysis, Economy, Macro Outlook, Trading, Day Trading, Swing Trading, Investing, Dow Futures, S&P Futures, Stock Market Education, Market Forecast, Market Opinion and Analysis, EchovectorVEST, Portfolio Insurance, Portfolio Management

Simple template. Powered by Blogger.

AFFILIATE MEMBERSHIP

Themes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View, Alerts,Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis,Long Ideas,Commodities, EchoVectorVEST, Technical Analysis

No comments:

Post a Comment